Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Work in the 21st century: global, remote, and self-managing

Through COVID the world experienced a shift to a digital model of operation. Remote work and education became the norm. Business trips made way for video conferences, homes became offices, parents and children met at home during work hours, workers realized a significant part of their time was spent on the road. With their newly gained freedoms, some opted to work late into the nights or have breakfast with their families before starting their days. Individuals started to experience self-management. They gained control of their time.

This is just a taste of a brand new model for organizing human efforts. The classical model of 9-to-5 is no more. In its place is a new model that values personal freedom.

Global: Participants can be from anywhere in the world

Remote: Interactions happen through digital communications

Self-managing: Participants take an active role in deciding what to do

Today, blockchains and smart contract technologies enable individuals to participate in global networks, trade assets without middlemen, and take action towards common goals. We are at the beginning of a global shift and decentralized communities are the pioneers.

These communities remove the need to start businesses to solve problems while allowing greater autonomy for individual participants. Each participant’s value is based on their own skills and abilities. Each interaction is peer to peer. The qualities of this model of operation are:

Individual leadership: Participants can take on initiative, each can lead in collective efforts

Asynchronous: Participants work on their own time, without constant interaction with others

Voluntary participation: No mandatory 9/5. Participants define their own role, commitment, responsibilities. They take on as much as they please.

This model grants individuals more power and freedom to shape their lives. Individuals are free to select where and how they work, so they can work from anywhere in the world. They can take on as much or as little work as they please, to fit their life. They can fit the time to learn about new fields, adapt their work to the needs of the time and , what value they can provide to society.

Original research on decentralized organizations, the tools that make them work, DAO tools, Cardano ecosystem, the regulatory picture and more.

Welcome to littlefish Foundation's research hub.

Our research hub covers many areas yet is guided with the perspective of a decentralized organization building on the Cardano blockchain. As such it will be useful primarily to Cardano users, Cardano DAOs, and Cardano builders, but all blockchain users may find something useful here.

In this resource you can find information on:

In depth reviews of DAO Tools building on Cardano:

In depth looks at some Cardano DeFi projects: Cardano DeFi

Digital work tools that help enable the type of work in DAOs: Remote Work Tools

Analysis of many blockchain regulations from token launches to tax implications: Blockchains and Law

The state of cross-chain on Cardano: Cardano Cross-Chain Solutions

Case studies of top DAOs, the tools they use, and their governance basics: DAO Case Studies

and more ...

We are a Project Catalyst powered organization. Project Catalyst is the innovation platform that funds projects building on the Cardano blockchain.

This research hub is prepared as part of three of our funded proposals in Fund 9:

Tools of DAO Work: Cardano DAO Tools, wallets, and digital work tools that enable the work of DAOs.

Ocean Technologies: Cross-chain technologies on Cardano, and interesting tech from other blockchains. https://cardano.ideascale.com/c/idea/64180

Law and the New Order: Original research by the legal team at Tevetoglu Legal, analyzing the intricacies of various regulatory topics in blockchains. https://cardano.ideascale.com/c/idea/64605

The frontier of organizations, welcome to the messy world of DAOs

DAOs are organizations that operate based on rules encoded as computer programs. They promise a new world of organizations that are transparent, voluntary, and controlled by their members. Their financial transactions and rules are maintained on a blockchain for all to observe and verify.

Let's unpack each part to understand DAOs better:

Decentralization: This refers to the lack of a central authority. In a DAO, decisions are made collectively by the organization's members, not by a single leader or a select group of executives.

Autonomy: DAOs operate automatically and independently. They are governed by smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. When their conditions are met, smart contracts execute automatically, removing the need for human interaction to make things happen.

DAOs are made possible by smart contracts. A DAO in control of its smart contracts can unlock all potential benefits of blockchain technology. Cardano Smart Contract development is a difficult and time-consuming skill to master due to the usage of Plutus. The Smart Contract Development Tools can make developing your own smart contracts easier, or provide smart contract templates for you to edit to your specific needs.

These are the tools that don't fit in our categories but can be very useful for DAOs.

Organization: Despite being decentralized and autonomous, DAOs are still organizations. They have members, they make decisions, and they aim to achieve certain goals.

DAOs are a new way of organizing human activity. They combine the principles of decentralization, autonomy, and organization in a unique way, enabled by blockchain technology. They have the potential to democratize decision-making, increase transparency, and reduce reliance on centralized authorities.

With the advancement of the blockchain technology more and more people start to invest and use crypto currencies. If users do not want to keep their assets in exchange markets, like Binance or FTX etc. they use digital or hardware wallets. Generally in exchanges there is some certain security along with the user’s own responsibilities, using strong password, activating 2FA. With the wallets, users should also make sure to keep their account secure. This security is further implemented with the usage of seed phrases.

A seed phrase, or a recovery phrase, is a 12, 18, or 24 word phrase in a certain order that can be used to access a crypto wallet. If you forget your password of your digital wallet or lose your hardware wallet you can still access your wallet with the help of these seed phrases. You can think of these seed phrases as the master key in the hotels.

If you also lose or forget your seed phrase you will lose access to your wallet and whatever crypto you own in it forever. With the same logic, whoever knows your seed phrases can access your funds. So it is really important to keep these secure.

Different ways you can store these phrases from least secure to most secure are;

Using a service like Google Keep, etc.

Writing down to a notepad app locking the app

Writing down to paper and securing it safely

Engraving on a metal plate and securing it safely

As you may have noticed offline methods are more secure than the online ones since they are hack-proof. To further increase the security of these you can do any of these things;

Using Ghost Ink (words will be readable only under UV light)

Keeping the paper or plate under lock

Using substitution cipher (or keyword cipher) cryptography method for the phrases

But of course there are risks to offline methods as well, like losing the plate you have engraved or burning of the paper in a fire. Even though there are minimal probabilities for these to occur, it never is zero. Our final suggestion would be, never keep your phrases in one location, rather store them in different places away from each other.

The Ocean is what we call the vast ecosystem of blockchains. DAOs, the tools they use, and what the ADA ecosystem needs to build in the future to catch up and compete with other chains.

Beyond Cardano lies a vast ocean of blockchains. Our research covers a tiny slice of it. As an open DAO, we are mostly interested in DAOs and DAO tools, but we have also researched some other technologies on other chains that may be useful for Cardano builders.

Here you will find:

Deep dives into top DAOs like Uniswap and AAVE and the tools they use to operate their DAO in DAO Case Studies

Reviews and analysis of various DAO tools that we found were in frequent use in our Tools of the Ocean Report

These tools are designed to help developers track, contribute and organize their work.

Actions are NFTs that hold within them the record of work.

littlefish perform real-world activities.

A group of friends cleaning litter on the beach.

A digital community collaborating towards social/environmental impact.

A DAO creating blockchain solutions for a use case.

A business announcing/developing/producing a new product.

A charity organizing a new campaign to build houses for those in need.

These activities are documented in whatever way the littlefish choose - video, image, recordings, tweets, Instagram, … Collected multimedia is then published as NFTs called Actions.

This category of tools are to help a DAO manage their treasury and process their payments.

One of the popular tools for treasury management is multi-signature wallets. The name wallet can be misleading because multi-signature or multi-sig wallets resemble safes more than wallets. These wallets require more than one key in order to access assets in them like bank safes.

A DAO is a decentralized organization but if their assets are kept in a regular wallet address, that is centralized. Any person in possession of keys to that address is in full control of the entire DAOs treasury. Multisig wallets offer decentralization of this power among certain members of the community and they also offer the ability to lock assets before or after a certain date.

Another type of DAO tools falls into this category are Project Management Tools. these tools track tasks done by members and process payments automatically according to tasks done by the community of a DAO.

Here are the Treasury Management and Payments DAO Tools we have researched:

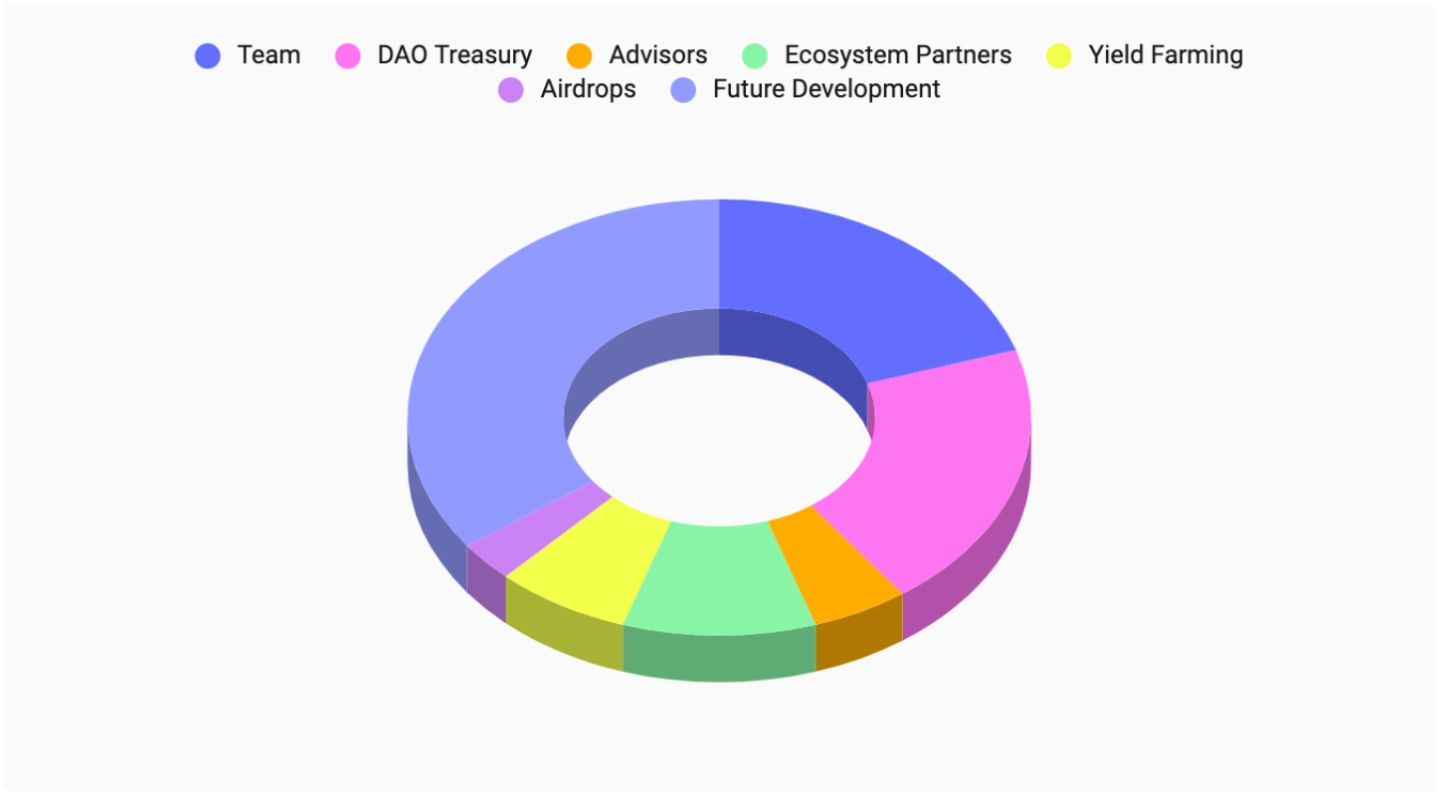

DAOs usually use tokens to raise initial investments and share their governance with their community. These tokens are used in DAOs governance and have voting power on proposals. Some DAOs also give proposal power to people with more than a specific amount of tokens.

The tools in this category make it easy to create and distribute tokens for DAOs. The distribution of tokens can be done by airdrops or vending machine methods.

Airdrop: This method distributes tokens created to a list of addresses provided by the DAO.

Vending Machine: Members collect tokens from a dApp themselves.

DAOs can also mint their tokens however they choose. For example,

A DAO can mint all tokens at once

They can mint tokens gradually

Tokens can be minted when someone claims them.

Membership and Reputation Tools allow individuals to show their skills on-chain and DAOs to find the right people. They also offer the ability to allow certain individuals with specific tokens or NFTs to access certain DAO resources.

The ability to control certain token or NFT holders access can be very beneficial for DAOs and prevent scam attacks.

The on-chain skill proof can be used like a CV for people to show their skills in a more trustworthy way.

Here are the Cardano DAO Tools we have deep dives on:

These tools are designed to organize, plan and manage social media accounts. They also provide valuable statistics about the interactions the social media accounts have.

Here is the list:

Wallets, DAO tools, DeFi, cross-chain, and Catalyst

Below you'll find our research on the Cardano ecosystem covering

Cardano wallet reviews and comparisons

DAO Tools building on Cardano if you want to make a DAO in Cardano

DeFi dApps

Governance is the backbone of any DAO. Decision-making, voting, and decision enforcement can be made on-chain by Governance DAO Tools. When setting up your DAO, you can choose the governance method you want. Governance DAO tools allow DAOs to set up a fully functional on-chain governance platform without writing code.

These tools allow DAO administrators to set up their governance method according to their needs. They handle all the on-chain and off-chain parameters of your DAO. You can use the platform of the tool to set your DAO up. This process is usually filling out some forms about what your DAO is, the governance token you use, and the governance rules you want. Then your members can start using the web app to participate in your DAO. These tools are very easy to set up but they can be limited in terms of customization.

Governance tools that provide smart contracts to set up governance like Agora Protocol are difficult to set up but they offer much higher customization potential.

What solutions exist to allow collaboration between ADA and other chains?

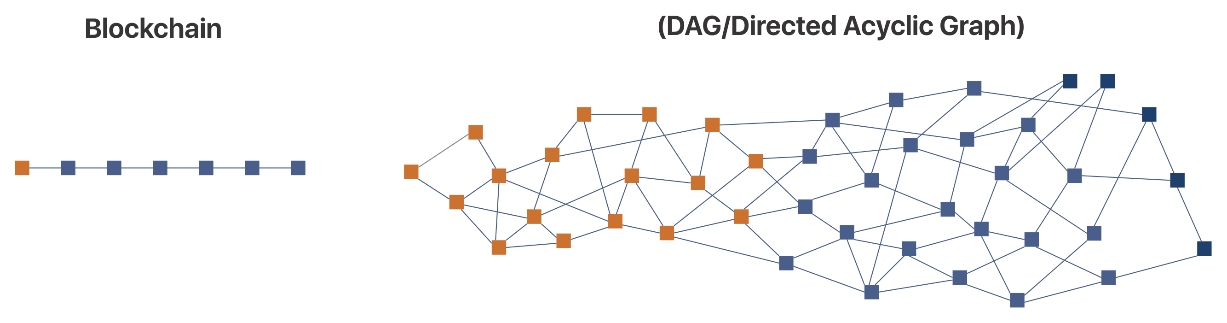

Cross-chain refers to the interoperability between different blockchain networks, allowing assets and data to be transferred seamlessly from one blockchain to another. This is crucial for enhancing the utility and scalability of blockchain applications. Various technologies like atomic swaps, oracles, sidechains, and blockchain bridges facilitate cross-chain transactions.

See our articles that cover cross-chain concepts in detail:

DAOs are made possible by smart contracts. A DAO in control of its smart contracts can unlock all potential benefits of blockchain technology. There is no place for mistakes in Smart Contract development. Smart contracts are immutable, which means when deployed, you can not change a smart contract. This is one of the reasons why smart contracts are safe but it can also have serious consequences. An error in the code of a smart contract can cause loss of funds permanently. Since the smart contract can not be changed, the funds you lost can never be saved.

Smart Contract Development tools aim to help developers deploy better smart contracts. Developers can choose a smart contract they need from the library provided by these tools and edit them according to their specific use cases.

Membership and Reputation Tools allow individuals to show their skills on-chain and DAOs to find the right people. They also offer the ability to allow certain individuals with specific tokens or NFTs to access certain DAO resources.

The ability to control certain token or NFT holders access can be very beneficial for DAOs and prevent scam attacks.

The on-chain skill proof can be used like a CV for people to show their skills in a more trustworthy way.

Here are the DAO Tools we have researched:

Decentralized organizations need a way for self-organization to happen. Individuals participate from all over the world, at different time schedules, with varying rates of commitment to the organization. There is no constant interaction between members, tracking the contributions of individuals is difficult. There is no visibility to work done. Who did what gets lost. Information stays in the hands of a few and doesn’t spread effectively. Without visibility, individual efforts don’t align with common goals. Action doesn’t count.

That's why we conceptualized the . They are the way in which we communicate with each other, the things we have done, the steps we have taken, the work we do.

As of mid November we're developing our application for littlefish Foundation to run on Actions. Until then, we are playing with the concept in our Discord channel, where we post the Actions we have taken in dedicated channels. This communicates to the rest of the community what we do.

Welcome littlefish, we're glad you're interested in becoming an active part of our community. This document is your guide to all things littlefish Foundation, helping you get up to speed, and find the information you need to become a core member of our growing community.

If you find something that is not here, but you think should be, let us know in Discord so we can update this doc.

Cross-chain solutions like bridges and oracles

Project Catalyst, the innovation engine of Cardano

Cardano wallets are the most essential way to be in the Cardano Ecosystem. A user keeps their assets in them and they use their wallets to connect to different tools on the blockchain like dApps.

We have reviewed the most used Cardano light wallets and here are all of them.

DAO tools are software applications built on blockchain technology that facilitate the creation and management of DAOs. DAOs are organizations that are fully decentralized and autonomous, with decisions made through a consensus process on the blockchain. DAO tools can include platforms for creating DAOs (like Summon Platform or Clarity Protocol), and blockchain platforms (like Ethereum or Cardano).

Decentralized Finance, or DeFi, is a revolutionary movement in the financial industry that leverages blockchain technology to disintermediate traditional financial intermediaries. DeFi tools are the various applications, platforms, and protocols that facilitate this new form of finance. They are designed to recreate and improve upon the financial systems we have today but in a decentralized, open, and transparent manner.

For more detail: Cardano Decentralized Finance Tools

Cross-chain is the interconnection of two or more entirely different blockchains. It allows the transfer of assets and data between different blockchains.

For more detail: Cardano Cross-Chain Solutions

Catalyst is a $50M+ open innovation fund. Anybody with an idea to further the goals of Cardano may apply for funding and pursue their idea. Read about the tools that make it go round and how to get involved here: The Tools of Project Catalyst

Cardano

Multisig Wallet

Cardano

Multisig Wallet

TosiDrop

DripDropz

There are several bridges currently available on Cardano fulfilling a range of services. See below full articles covering each:

Some tools are available yet not under further development:

Charli3 is the standalone Oracle that is currently available for Cardano builders. See the article for an indepth look.

Yet there are other projects that are currently under development to deploy oracles on Cardano:

Oh wow you've made it all the way here. You really are interested aren't you? Great to hear, let's give you the grand tour. littlefish Foundation is made up of 5 groups:

The Forge - The builders of littlefish Foundation. Developers, designers, token engineers, the hard working grunts who make the coolest stuff on the planet.

Love House - The home of happy humans who love sharing stories, making everyone feel nice and fuzzy. Community builders, communicators, facilitators, content producers, promoters are all at home here.

Tech Help Collective - The world is confusing to the non-technical person. All this technology around us and nobody to help us understand it. No longer. The THC is here to help.

Organization Labs - It ain't easy being on the bleeding edge of organizations. How do we organize in this wild west is the business of OrgLabs. If you fashion yourself an organization designer, this is the place to be.

Dream Engine - Dreams are the beginning and end of all we build here. littlefish Foundation began with dreams and it shall only continue insofar as the littlefish who make it remain avid dreamers. This is the home of philosophers, visionaries, and oracles.

You can find these groups on Discord. Jump into those chats and meet your folk.

Woah, woah, woah, slow down there. This is a big rabbit hole you fell into. You need sometime to orient and adjust. Take your time.

Start with: Contributor Guideline

Cardano

Dev Tool

No Code

No Code

No Code

No Code

No Code

Ethereum

Ethereum

Ethereum

Ethereum

Ethereum

Cardano

Cardano

If you decide to contribute, the final product of your work, and perhaps some intermediate steps will be an Action. Your contributions will live forever onchain.

We use all the technology available to us. We research them, compile resources with guides, and additional resources in this Vault for all to use.

We are currently working on compiling the [[littlefish Tools of Work]], it is an incomplete list of the tools we use to make work in the decentralized world simpler.

We run 2 week sprints to align the efforts of our community. littlefish sprints have three parts:

Start with a sprint planning meeting, usually held on Mondays.

We keep each other accountable by posting our progress in the sprint-standup channel in Discord.

At the end of each sprint, we hold an Action(demo) day where we show what we worked on, then do a sprint review session.

We run these sprints on Dework: https://app.dework.xyz/littlefish-foundatio

You can find the exact dates for the sprints on our google calendar.

In littlefish Foundation, we run on the belief that each individual has the knowledge and capability to work in freedom, to decide for themselves the best course of action, and to listen to other stakeholders when making those decisions.

This means each individual is expected to self-manage. To identify opportunities in the organization where they can provide value, and to self-organize with respect to the community and organization.

Gitbook and the Vault are our collective knowledge base. They are the places where we pool our knowledge. Any research we do, guides we write can be found on our Gitbook and process we develop, and implement, should eventually find its way to the Vault.

We manage the Vault on github:

Author: Emir Olgun

Date: 18 October 2023

We in the littlefish Foundation have conducted one of the most comprehensive researches about Cross-Chain capabilities in Cardano blockchain. This report will present What is Cross-Chain, Cross-Chain Concepts, and Cross-Chain Services that are currently operational and ongoing projects.

Cross-chain refers to the interoperability between different blockchain networks, allowing assets and data to be transferred seamlessly from one blockchain to another. This is crucial for enhancing the utility and scalability of blockchain applications. Various technologies like atomic swaps, oracles, sidechains, and blockchain bridges facilitate cross-chain transactions. The goal is to create a more interconnected and efficient ecosystem, where one is not limited by the capabilities or assets and services of a single blockchain. For some of these concepts we have written documents as they are complex technologies.

We also have done research on all the Cardano cross-chain tools we found. Some of these projects are ready to be used, some are still in development and one tool called Microchains was functional but is dead.

These are the operational cross-chain bridges on Cardano:

Here are cross-chain bridges that are not operational:

Here are the operational Cardano oracles:

Here are projects that announced they are working on Cardano but not yet deployed an oracle:

As of October 2023, there are not many services for Cardano cross-chain but with new services expected to come online, it looks promising. There are currently couple of available cross-chain bridges, one oracle, one atomic swap, and one expected sidechain. Even though the only oracle solution on Cardano, Charli3, does not offer much services, it has a strong and promising technical infrastructure and it definately has the potential to become dominant oracle service for Cardano.

This research was carried out on 1Inch DAO. This task is about learning about the DAO tools this DAO uses and its onboarding process.

1inch is a worldwide network that consists of different decentralized protocols tailored to provide the most rewarding, fast and safe operations in the DeFi space. 1inch Network uses the powerful characteristics of all popular chains such as Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, and Avalanche for giving its users ultimate flexibility for swapping any digital asset they hold.

1inch DAO uses their forum and Snapshot for governance operation. 1inch network governance process welcomes everyone, anyone can creare a proposal (1IP), or vote on any existing proposal. These proposals will be funded by the 1inch Network Treasury while its implemented by a third party.

There are 5 phases of 1inch DAO governance.

Phase 1. Governance starts in the 1inch DAO forum. Anyone can create, and comment on current proposals. Navigate to the in the 1inch forum.

Phase 2. 1IP Formalization, to create an official 1inch governance proposal, you must . All official 1inch proposals (1IP) must follow the same structure.

Phase 3. 1IP Temperature Check, the creator/author of the proposal may finalize their proposals (phase 2) then initiating a community temperature which have a duration of 5 days. To start the Temperature Check, the author should navigate to the 1inch forum and change the tag of the forum to Phase-3 and make sure to add a forum poll gauging the community sentiment.

N.B: Each poll is open for 5 days, once phase-3 commences, it cannot be reversed.

Phase 4. The proposal are not taking to Snapshot to conduct an off-chain voting. If voted in, it will be implemented on-chain. The Snapshot proposal is open for a voting period of 7-days.

After a successful voting period has concluded on Snapshot, the results will be published on on the governance documentation website. Any passed proposal will move from Active to Passed category. If it does not Pass, it'll be moved to Not-Passed.

Snapshot

Snapshot is a decentralized DAO voting platform that allows users to create governance proposals and vote off-chain with spending any gas fees.

Resources:

protocol sources liquidity from various exchanges and ensuring the best rates.

is a fast and secure iOS wallet for storing, receiving, sending and swapping crypto assets.

Onboarding only takes a few second. Follow the . Read the channel rules, choose what channels you’ll like to explore, and verify your account.

The 1INCH utility token is at the moment available on Ethereum and BNB Chain. The 1INCH utility token is used by the DAO members to govern all of the 1inch Network protocols either present or in the future. It is also used in the governance modules of the 1inch Aggregation Protocol and the 1inch Liquidity Protocol.

INTRODUCTION

The purpose of this research is to get a clear sense of what Illuvium DAO is all about. We also want to know the tools they use to enhance the growth of their organization as well as governance process. To begin with, what is Illuvium?

Illuvium exists to be a decentralized Ethereum role-play game. The Illuvium blockchain game was designed to enable users play and earn in-game rewards by engagiging with quests and competitions. Furthermore, Illuvium digital world is opne to everyone - Users can search for in-game items and creatures called (Illuvials) in the form of non--fungible tokens (NFTs). These collectibles can be used for battling, collecting, and trading as well.

ILV is an ERC-20 governance utility token that is used to govern the Illuvium DAO and it is also the main currency used to award players for their awesome achievements in the game.

The goal behind the Illuvium project was to make a collectible NFT game that was open, transparent, and governed by the community member. Illuvium uses an off-chain voting system (Snapshot).

The Illuvium DAO governance mechanism is as follows:

A community of $ILV holders will govern and maintain the protocol, using the Illuvinati Council. The $ILV utility token holders have a say in the Illuvium decisition-making process - holders of the $ILV token also have the ability to nominate an individual for a council seat as well as delegate their vote to a nominee. To elect a group of council members, their desired candidates for council members must be proposed before the due date of the election.

Following that, the voting will commence and run for a period of 72 hours to elect the 5 individuals best suited for the role of governing the platform. At the end of the Election Period, the council members will be issued their NFTs.

The "eDAO" alongside "Illuvinati Council" is the Illuvium initial governance model and is subject to change - After the council members have been elected, the eDAO will then collate all proposed members from the Illuvium Discord Channel Illuvinati Council, then proceed to prepare the candidates to be voted on in an off-chain manner within Snapshot.

There are two major components of the new governance system:

The Illuvinati Council: This consist of a group of nominees who are voted in by the $ILV token holders.

Illuvium Proposals: Any one looking to propose changes to the Illuvium protocol or have a say in the decision-making process must go through ICCPs and IIPs. The ICCPs and IIPs are submitted to the IIP’s Github repository and posted on the Illuvium Proposal space afterwards. Any proposals that doesn't reach a supermajority agreement will not be enacted.

ICCPs is the short for Illuvium Configuration Change Proposals, they are documents that put forth a case for modifying within the DAO. On the other hand, IIPs stands for Illuvium Improvement Proposals. They always ensure that changes to the Illuvium Protocol are transparent and well-governed. An IIP is a design document providing information to the Illuvium community about a proposed change to the system.

The period where the proposal is in review before being implemented, initially set at 24 hours.

Snapshot is one of the worlds leading voting platform for DAOs, it enable DAOs, DeFi protocols, or NFT communities to cast votes in a hassle-free manner without gas fees. For greater benefits, Snapshop allows for the customization of the voting process to meet the needs of the users and organizations.

To get onboarded is quite simple - If you want to keep up with the latest trends and community discussion, you can . Follow the prompt and verify your identity!

There are numerous ways players can earn the ILV utility token. Aside from purchasing them across decentralized exchanges like (Binance,Coinbase, Sushi), the ILV token holders are also allowed to partake in esports tournaments, resource farming (harvesting/picking plants, or mining minerals), Illuvium zero, collectiong Illuvials (they are NFTs that can also be traded on a marketplace), and interacting with in-game activities to earn yield.

Publication tools are of paramount importance for DAOs (Decentralized Autonomous Organizations) as they improve the visibility of the them and the work they do. In an ecosystem where transparency, trust, and open communication are foundational, publication tools facilitate the dissemination of information, from governance decisions and financial reports to project updates and community initiatives. These tools not only provide a platform for DAOs to articulate their vision, values, and progress but also empower community members by keeping them informed and involved.

Knowledge Sharing tools are very useful for DAOs because they provide a structured, collaborative, organized, and intuitive platforms to publish content. These tools empower DAOs to be easily accessible, transparent and organized.

: Gitbook provides an intuitive interface for collaborative documentation, making it easier for DAOs to create structured and accesible content for both internal operations and public outreach.

: Docusaurus is easy to use platform and highly customizable since it is built using React. DAOs can easily create their own components and customize their website however they want.

Obsidian: Obsidian, with its bi-directional linking, allows DAOs to craft a deeply interconnected knowledge base, highlighting the relationships between various concepts and projects.

Newsletters are very important services for DAOs like any organization. They provide consistent publicaiton of information about the DAO and they also help building community and increase engagement and participation. Newsletters can also be used for archiving and record-keeping of DAOs activities.

: Buttondown is a simple email newsletter service that supports Markdown to create newsletters.

A strong existence in social media platforms is crucial for DAOs. Social media posts can significanlty increase visibility and help DAOs to attract new members. The downside of social media is the competition. In order to get significant outcomes, DAOs need to create new posts consistently. Social Media Management Tools, with their features like post scheduling and analytics, can help DAOs to generate consistent social media posts with little effort.

Vespr wallet is a very convenient, easy to use and secure mobile wallet.

It is available on iOS, iPadOS and Android.

Browser extension support is coming soon.

Vespr has biometrics support on iOS and iPadOS devices.

Vespr has light and dark modes.

Crypto asset values can be seen in USD.

Vespr wallet is not open-source

NFTs and Tokens can be seen on Lace wallet.

There is no address book support.

Vespr wallet supports multiple wallets.

Vespr wallet has preprod testnet supports.

Vespr wallet does not have dApp support.

Vespr currently does not support hardware wallets

Vespr supports 12, 15, 24 word seed phrases.

Please let us know if you encounter any issues.

Android app will be tested in the future.

Review on : 9 March 2023

Chrome extension, Web UI, iOS and Android apps..

Crypto assets' value can be seen in a wide variety of FIAT currencies

Multi-chain Support Supports Cardano, ERC-20 tokens, Bitcoin and many other assets

Buy and Sell Crypto Supports Mastercard, Visa and Applepay ( transaction fees will be applied )

Short article about liquidity mining

Tokenomics

No support

CardWallet supports 12-15-18-24 word seed phrases

The biggest feature of CardWallet is that it supports many tokens in the Ethereum and Cardano network. There are send and receive options for these assets.

CardWallet social media activity stopped in May 2022.

Review on : 9 March 2023

GeroWallet available as a browser extension, compatible with all Chrome based browsers. There is no Web-UI for now. They recently released iOS and Android apps.

USD Value of ADA is visible

Multi-Wallet Support Create and Import multiple wallets (up to 8 ) with web-extension application

Send and Receive ADA Only supports Cardano, Cross-chain support will be added in the future

GeroWallet is not open-source

GeroWallet supports Ledger and Trezor model hardware wallets.

GeroWallet supports 15-24 word seed phrases and Cardano wallets.

GeroWallet allows staking, a minimum of 4 ADA is required for staking.

Video explanation on how to staking with GeroWallet

GeroWallet ecosystem is managed by a token $GERO which is previously mentioned on the documentation. Users will use this token for

Staking To be eligible to receive a portion of platform fees from services, such as swaps, made available through wallet integrations.

Staking to the proper tiers to receive discounted prices for the wallet's services.

Vote with your tokens on the wallet's future direction and usage restrictions, including the fee and reward schedules.

GeroWallet is very

GeroWallet is a promising wallet in general, It is said that many features will be added in the future.

You can follow the news about GeroWallet here

DAOs need to generate variety of content ranging from whitepapers and onboarding documents to social media posts and short videos. These contents often increase DAOs visibility and announce who they are and what they do to the outside world. Our content generation tools aim to improve quality and decrease the content generation time significantly.

In today's world, lots of people have extremely short attention span and they mostly prefer visual content rather than written content. Video generation and Voice-Over tools can be used to prepare short social media posts for platforms like Instagram and TikTok or videos explaining what the DAO does or videos explaining the onboarding process of the DAO.

Fliki: Fliki is a text-to-vide generation tool. It has a built-in AI image generator and a library of free images and videos to choose from. Fliki also supports a variety of languages.

: Murf AI is a text-to-speech tool that uses AI. It has a selection of voices and mimics human emotions like anger and happiness.

: Steve AI is a video generation tool that can generate animation or live videos from text and audio.

Website creation is a challenging task that requires a group of people with different skills. DAOs often need their own website to improve their visibility and creating a website from scratch is a very expensive and time consuming process. No-Code Website Creation Tools make it possible for people with no technical background to create beautiful and functional websites in a short time.

: Bubble is a no-code website creation tool. It supports a variety of features from payment processing to map integrations. It has a learning curve but it is much easier and cheaper than conventional website creation process.

Generating written content is the most essential part of content generation. No matter what content is generated, writing tools usually are the beginning of any content. For example, writing tools can be used to generate the script for a video content. Writing tools can be used to help the writer generate better content in a shorter time and unblock writer's block.

: Copy.AI is a writing tool that can be used to generate posts ranging from ads to blogs.

: Jasper AI is a writing tool where you can write variety of different content and choose the tone of your writing.

: Penelope AI is a markdown editor that uses machine learning technology to help the writer generate better content.

: WriteSonic is a writing tool that aims to create high quality content in a short time.

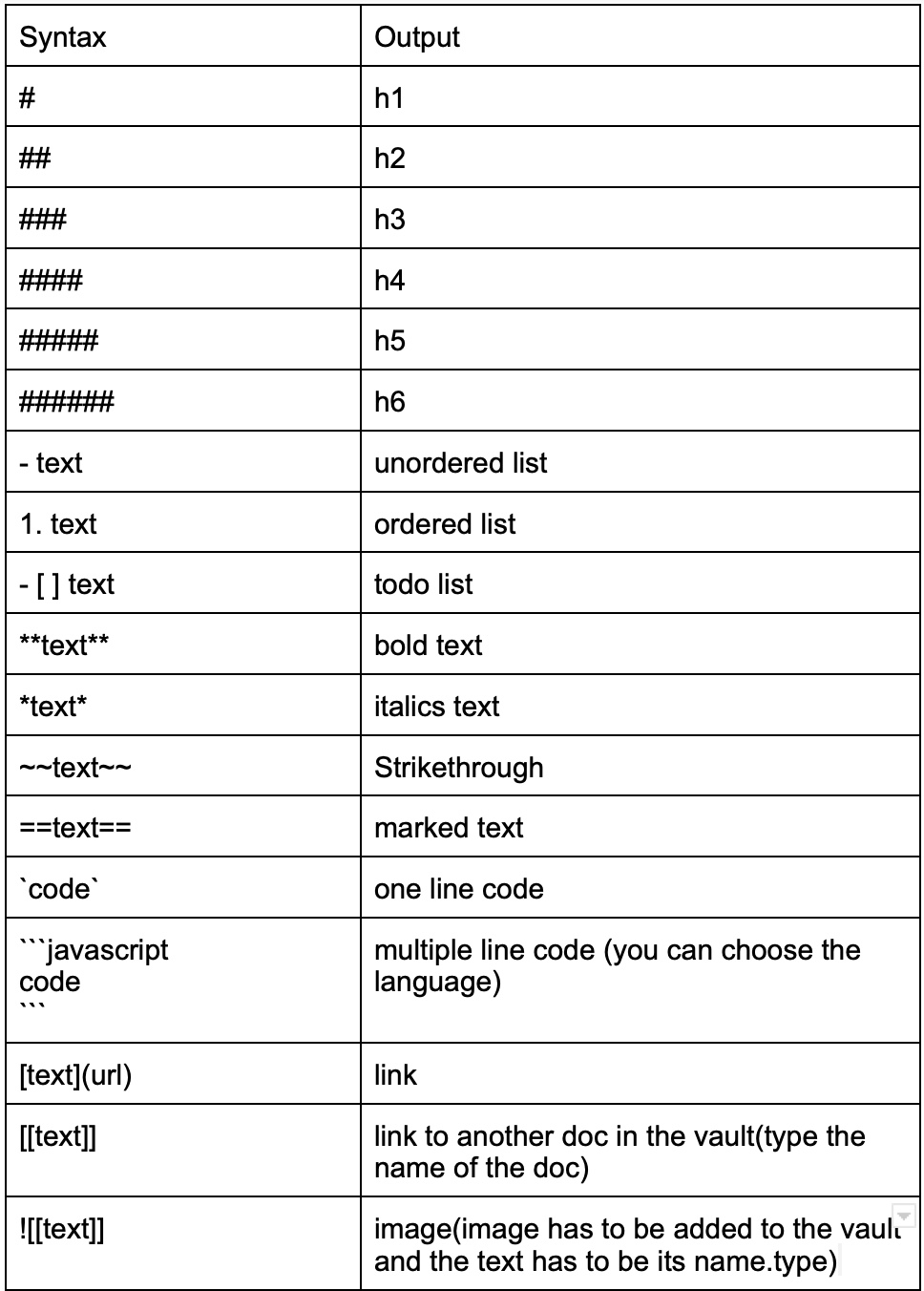

We strongly recommend writing your documents in markdown format. This is a very generic document guide, you do not have to follow this guide if you know what to do. If you are not sure about how to write your document you can use this guide. Using ai tools like chatGPT can be useful but every information generated by ai has to be verified and we expect writers to learn and understand the topic they write about. During reviews, documents will be checked for ai generated content.

Example of a good document: Cogito Protocol. You do not have to write a document that utilizes this many tools of markdown but we do not protest if you do.

Another example of a good document: Indigo Protocol. This document does not entirely fit this template and it does not have to but it is also a good document because it is clear and easy to read. Also unfamiliar concepts are explained clearly.

What we want in a document is usage of markdown syntax and clear headers to make the document eye-catching and easy to read. We want usage of organized headings and sub-headings in the document. A simple example is Introduction, Body and Conclusion.

In the Introduction part, you should explain what the tool is and what it is used for briefly.

In the Body part, you should dive deep into the questions of the previous part and also write a detailed explanation on how a DAO can benefit if they use this tool.

In the Conclusion part, please summarize the main points and restate the key points.

There is also an Additional Information part, on that part we want you to put the relevant links about the tool and the links of new tool if you encountered any other potential DAO tools that you think might be useful.

You do not have to use the headlines explained above but the content of the document should be similar.

Note: The images you upload should be a folder named by the tool you are writing added into the images folder.

Examples of multiple line code in different languages, as you can see different syntax highlighting according to the language.

Oh wow, you've found us dear contributor. Welcome to a small pond of littlefish working together to impact the world. Things here may confuse you. That's OK, as long as you keep curious.

And you are a curious one aren't you? Finding this page among a sea of others. That's good. You will need your curiosity. littlefish Foundation is full of opportunity for those who look for it. This page will give you some guidance but you've got to grab it.

If you don't know much about littlefish, the first and best thing you can do is explore.

The information channel on Discord has all the relevant links.

The Vault is the place of our , and .

Browse through the action channel on Discord if you wanna get dazed and confused.

Ok, now that you feel like you've got a grasp of maybe 10% of what's going on, that's a good time to get involved :D

But then, you ask yourself, what can I do to help around?

Well, we have a special way of answering that question: Ikigai.

This is a Japanese philosophy meaning A Reason for Being. We use a specialized version of the philosophy that comes nowhere near capturing the entire beauty of it. But hey visualizing an entire philosophical concept is not easy ha? Ehem, back to the topic.

We want you, random person on the internet who is about to become our friend, to find your reason for being here. We want you to do

what you love

what you're good at

what the world needs/what we need

waht you can be paid for

The Roles of Fish Miro board will show you how:

To become an effective contributor, littlefish must learn the tools of work. Don't be afraid, we've got you covered with the . Check it out for information about the tools we use to become awesomefish. If you feel some information is missing, drop by Discord and ask in the ask-tech channel. Tech Help Collective is there to help.

Treasury Management and Payment Tools are to help a DAO manage its treasury and process its payments.

One of the popular tools for treasury management is multi-signature wallets. The name wallet can be misleading because multi-signature or multi-sig wallets resemble safes more than wallets. These wallets require more than one key in order to access assets in them like bank safes.

A DAO is a decentralized organization but if their assets are kept in a regular wallet address, that is centralized. Any person in possession of keys to that address is in full control of the entire DAOs treasury. Multisig wallets offer decentralization of this power among certain members of the community and they also offer the ability to lock assets before or after a certain date.

DAOs usually use tokens to raise initial investments and share their governance with their community. These tokens are used in DAOs governance and have voting power on proposals. Some DAOs also give proposal power to people with more than a specific amount of tokens.

The tools in this category make it easy to create and distribute tokens for DAOs. The distribution of tokens can be done by airdrops or vending machine methods.

Airdrop: This method distributes tokens created to a list of addresses provided by the DAO.

Vending Machine: Members collect tokens from a dApp themselves.

What are DeFi Tools?

DeFi tools are essentially a wide range of decentralized applications (dApps) that can perform financial functions such as lending, borrowing, trading, investment, insurance, and more, without the need for a centralized authority.

Types of DeFi Tools

Decentralized Exchanges (DEXs): These platforms allow users to trade cryptocurrencies directly with each other, without the need for an intermediary. Examples include Uniswap, SushiSwap, and Balancer.

Lending and Borrowing Platforms

Governance is the backbone of any DAO. Decision-making, voting, and decision enforcement can be made on-chain by Governance DAO Tools. When setting up your DAO, you can choose the governance method you want. Governance DAO tools allow DAOs to set up a fully functional on-chain governance platform without writing code.

These tools allow DAO administrators to set up their governance method according to their needs. They handle all the on-chain and off-chain parameters of your DAO. You can use the platform of the tool to set your DAO up. This process is usually filling out some forms about what your DAO is, the governance token you use, and the governance rules you want. Then your members can start using the web app to participate in your DAO. These tools are very easy to set up but they can be limited in terms of customization.

Governance tools that provide smart contracts to set up governance like Agora Protocol are difficult to set up but they offer much higher customization potential.

Author: Emir Olgun

Date: 14 June 2023

Bro Clan is an open-source multisig wallet on Cardano Blockchain. Even if it is called a "wallet", the multisig wallets and normal Cardano wallets are profoundly different and their use cases have almost nothing in common. A multisig wallet opens the possibility of keeping assets in a more secure and, most importantly, a true decentralized safe. A multisig wallet is more like a safe in a bank. These "safes" are essential for DAOs because keeping DAO funds in a normal Cardano wallet would give a single individual a tremendous power and it is against the philophy of decentralization.

Bro Clan wallet currently is in beta test. It supports Mainnet, Pre Production and Preview Testnets. It allows the user to configure the provider. The provides are Blockfrost, BroClan and Kupmios(Kupo and Opmios). The Kupmios choice turns Bro Clan wallet into a full-node wallet.

Stablecoins: These are cryptocurrencies designed to maintain a stable value relative to a specific asset or a pool of assets. Stablecoins are often used in DeFi to reduce volatility. Examples include DJED, DAI, USDT, and USDC.

Yield Farming and Liquidity Mining: These are more advanced DeFi practices where users provide liquidity to a platform, often in return for governance tokens, with the aim of earning a return on their investment.

Derivatives Platforms: These platforms allow users to trade derivatives of cryptocurrencies. Derivatives are financial contracts that derive their value from an underlying asset. Examples include Synthetix and dYdX.

Insurance Platforms: These platforms provide coverage for various risks in the DeFi space, such as smart contract bugs or exchange hacks. Examples include Nexus Mutual and Cover Protocol.

Asset Management Tools: These tools help users manage their investments in DeFi, providing services like portfolio tracking, risk management, and automated investment strategies. Examples include Yearn.finance and Zapper.

The Cardano DeFi Tools we have deep dives on:

Indigo Protocol is an autonomous synthetics protocol built on Cardano. They give their users the opportunity to be exposed to the price of real-world assets in the blockchain environment.

Djed is Cardano's native overcollateralized stablecoin, developed by IOG and powered by COTI.

Liqwid is a decentralized and non-custodial liquidity protocol, built on Cardano’s Plutus smart contract platform that provides an efficient and secure way for users to participate as lenders or borrowers.

In order to understand multisig concept, we need to understand how a normal Cardano wallet works. A Cardano wallet, in most basic terms, is a safe that keeps assets inside. Like a physical safe, accessing the assets inside the wallet, the owner needs a key. When you make a transaction, you create a transaction by the assets in your wallet and then sign this transaction to be processed. Multi-signature or Multisig is a special type of wallet. In order to access the assets in these wallets, you need multiple keys very similar to vault in banks. A multisig wallet needs two or more different keys to sign the same transaction. This significantly increases security and decentralization. Also, multisig keys can have time limit. For example, some keys would only work until a specific date or they can be activated after a specific date.

Multisig

You can add as many signatories as you like for the wallet.

Timelock

Timelock is a very useful feature. It is used to limit the timeframe the wallet can be used. You can specify a specific date or even a slot for the wallet to activate and a date or slot for the wallet to lock permanently. Be careful, if the expiry date is passed, all the assets inside the wallet will be irreversibly locked.

Custom Multisig Policy

This is a very important feature. With this feature, you can specify how the transaction will be signed. For example, the transaction might require only one of the signatories, at least a number of signatories or all signatories.

Nested Policy

With this feature, you can get the customization to the next level. You can give some signatories a specific timeframe to be able to sign transactions, create a requirement of specific signatories and much more. Basically, your imagination is your limit here. It is a little hard to use this feature, be careful when setting it up.

We have tested the multisig wallet with different light wallets. Light wallets are very easy to use with Bro Clan, the signing process very simple and require no funds from these wallets as the transaction fees are paid by the multisig wallet.

Creating the signing logic is a little complicated. [Round Table] wallet definately does it better. Bro Clan supporting downloading transaction information is useful, but sharing the transaction with other people is difficult. It seems all participants will have to load the wallet and sign. Having a transaction URL to share would be more convenient. Also, we tried to import the transaction on some wallets and failed. Overall, Bro Clan is a wallet with significant potential. We will definately be following it when it becomes live on Cardano Mainnet.

Ask us anything on Discord. We love questions.

Hop on one of our calls. All of them are available on our google calendar.

Liquidity Mining

This wallet is not open-source.

NFTs and Tokens are not visible on the wallet.

There is no address book support.

Vespr wallet does not have staking support.

Vespr wallet does not support voting.

Buy ADA Buy ADA with credit card without need of a CeX (Centralized Exchange)

Collateral 5 ADA deposit is needed

Non-Custodial

dApp Connection Connect GeroWallet to supported web sites

Gero Token Swap ADA with $GERO token, available on SundaeSwap, Minswap and MuesliSwap.

NFT Display GeroWallet supports NFT display.

Another type of DAO tools falls into this category are Project Management Tools. these tools track tasks done by members and process payments automatically according to tasks done by the community of a DAO.

Here are the Treasury Management and Payments DAO Tools we have researched:

Cardano

Multisig Wallet

Cardano

Multisig Wallet

A DAO can mint all tokens at once

They can mint tokens gradually

Tokens can be minted when someone claims them.

Cardano

Cardano

Cardano

Cardano

Cardano

Cardano

Ergo, Cardano

Cardano

Ethereum

Ethereum

Agora Protocol requires technical people to set up the governance of a DAO since it is a smart contract library for DAO governance, not a governance app.

Paideia is online on Ergo blockchain but in development in Cardano blockchain.

Swae supports off-chain voting currently but currently has no on-chain support.

factorial :: (Num a, Eq a) => a -> a

factorial 0 = 1

factorial number = number * factorial(number - 1)INTRODUCTION

This research is centered on Balancer.fi - Since Balancer rose to prominence, the DeFi ecosystem witnessed a revolutionary introduction of the concept of multi-token pools. In the paragraphs below, we’ll learn about the DAO tools used by Balancer and how these tools are used in their governance process. Equally, we’ll discuss about the Balancer DAO utility token and how individuals can get the token.

Balancer is one of the novel and groundbreaking DeFi applications that acts as a token swap platform, a liquidity mining source, and an efficient liquidity protocol for integration into other DeFi protocols. Balancer runs on Ethereum (ETH), Polygon (MATIC), Arbitrum, Fantom (FTM) as well as Optimism.

With Balancer protocol, users can seamlessly set a custom trading fee and also provide liquidity for up to eight assets in a single liquidity pool — Cool!

The Balancer DAO governance proposal submission has two distinct items: An English Proposal and a Multisig payload for executing any chances described on-chain.

Here are the steps towards Balancer DAO governance

Step 1. The Balancer DAO governance process starts in the ; users will write an English language description of the purpose of the proposal and the details of the changes to be made. veBAL holders, also called Balancer Governors, vote on proposals relevant to the protocol.

Step 2. Moving forward, Balancer Governors can now participate in discussions on the Balancer forum as you promote your topic — you can also seek delegates to obtain their support. Sought for people who would resonate with your proposal and have them gather their thoughts in a forum post.

Step 3. Develop and validate transaction Pull Request: On Balancer, a Pull Request (PR) is a transaction that is posted to a gnosis-safe multisig which executes the changes specified by the BIP on-chain. It is required as part of the body of a Proposal, before it can be brought to a valid snapshot.

The whole governance process looks a little bit daunting but, if you don’t want to get involved in the technical side of things, like defining your execution, the Maxis are a service provider and they are funded and managed by the DAO on a rolling basis.

They are the ones managing the multisig. You can contact them for any help — they can be found on the and also .

In the situation where a Snapshot is approved by governance and perhaps rejected for technical reasons, the Maxis can help to fix the payload whilst facilitating a revote to approve.

Step 4. This is the fourth step towards a successful governance proposal — The Snapshot process will commence once an address amasses at least 200,000 veBAL in delegation posts a snapshot to the forum — keep in mind that the snapshot must meet all the required specifications

More so, the voting runs for 96 hours starting on a Thursday (GMT) with a quorum of 2 million veBAL. Even if your snapshot wins a majority of the votes but does not meet all of the above requirements, it will be regarded as invalid — Please, take your time when posting Snapshots.

Step 5. Results and Execution: Any vote that fails in an approve/reject vote will not be executed by Balancer governors; when a vote succeeds or has been chosen, be on the lookout to be sure it is executed properly.

To approve the off-chain votes carried on Snapshot, the Balancer Protocol leverages a Multisig to enact these changes on-chain. Multisig signers are a group of respected community members. Just so you know, they do NOT have decision-making power, their sole purpose is to simply enact on-chain the decisions BAL holders make via an off-chain voting system.

Snapshot is an open-source DAO tool that fascilitates decision-making processes within decentralized organizations. Snapshot is an off-chain gasless multi-governance client with easy-to-verify and hard-to-contest results. Balancer uses Snapshot to vote for their proposal.

Onboarding is very easy, to get started, simply , and verify that you’re human — you’re in!

Following that, the (BAL) token is a paramount asset for the Balancer protocol, Balancer DAO is governed by the Balancer (BAL) token holders. Community members can earn the BAL token through liquidity mining by depositing cryptos into Balancer’s liquidity pools. It can also be purchased via DEX exhanges such as Binance.

This research is conducted on Bankless DAO. Our aim is to discover the popular DAO tools they use for their DAO operation, including governance, treasury management and more.

BanklessDAO's mission is to help the world go Bankless. They’re creating a user-friendly onramps for people to discover decentralized financial technologies through education, media, and culture. Some of they’re values are: helping people adopt decentralized finance, promoting collective decision making and decentralized governance.

Before user proposals can get to the final stage, it must pass through this stages:

Bankless DAO governance begins in the Bankless DAO forum. The BANK token-holders must first publish their proposals on the forum to get feedback from the community members. This process is used to eliminate proposals that doesn’t meet the DAO values and standard.

2. Snapshot

BanklessDAO uses an off-chain voting platform known as Snapshot. Snapshot is used by the DAO for decisions related to the governance process, treasury allocation, and organizational structure. Any BANK token holder can vote in a Snapshot poll. The more BANK tokens they hold, the more voting power they have.

BanklessDAO uses the off-chain voting system; Snapshot is the tool used to vote on proposals.

Snapshot is a decentralized governance platform that enables DAOs to easily create and vote on proposals without spending on gas fees! DAOs can use various voting types so they can tailor the voting process to their needs.

Resources:

Boardroom is a governance platform that is designed to help DAO contributors make faster, smarter, and more informed decisions. The Boardroom API is an industry-leading source of governance data, such as delegation stats, vote history, proposal information as well as treasury.

Meanwhile, Boardroom is the source of governance data for BanklessDAO. Every information regarding proposals, number of users that voted, treasury updated can be found on Boardroom.

Resources:

Kleoverse is a DAO tooling app and credentialing platform that helps to maximize the efficiency of developers, community contributors and DAOs. Kleoverse helps in finding jobs, bounties, and organization-finding service just like LinkedIn. This is one of the platform to find job as a web3 developer.

Resources:

Onboarding on Bankless DAO is an easy step to follow, simply use the discord invite and verify that you’re human by answering the Captcha question, you’re in.

The only way you can participate in decision making or have a say in their governance process is by holding the native utility token (BANK). You can buy on various exchanges like Binance.

The purpose of this research is to learn more about the DAOs operation, which tools they use to bootstrap the growth of their organization, and how their governance process works…

Decentraland is a digital game that was built to mimic reality in 3-D and it is a user-owned, Ethereum-based virtual reality world platform. The users of this platform oversee this digital world via a decentralized autonomous organization (DAO).

MANA is the governance utility token for Decentraland DAO. MANA enables users to buy items such as wearables, invest in properties, develop and trade virtual land in decentralized manner.

How Does Decentraland use Aragon?

Decentraland uses the battle-tested security of Aragon client to secure and store their DAO treasuries. Decentraland holds off-chain votes for new proposals; when a vote is completed, commitee members uses Aragon to execute those votes.

How Does Decentraland Use Boardroom?

Decentraland uses the Boardroom tool to store updates including treasury, votes, proposals and more.

What more?

Decentraland also leverages multisig wallet as part of their DAO tool. The multisig wallet is controlled by the DAO committee (a group of 3 individuals) who have been selected by the community to hold the keys of the multisig wallet. This multisig will enact any passed votes with a binding action, like funding a grant, adding or removing a Poll or implementing governance.

Decentraland governance proposal has 3 steps: each step must reach the required threshold before it can be promoted to the next level.

A Pre-proposal poll

This is the first step to get to the final binding governance proposal. Decentraland Polls are known to be non-binding, multiple choice questionnaires used to measure community general opinion. If the Pre-preposal poll amasses enough participation VP (500k VP is the acceptance threshold), then the proposal gets promoted to the next level (Draft proposal.)

A Draft Proposal

A Draft proposal presents the community potential policy; it contains a structured discussion format, impact and implementation pathway of the proposal. Once a Draft proposal amasses enough participation (1M VP is the acceptance threshold), it gets promoted to the governance proposal.

A Governance Proposal

This is the last step towards governance. It must include details, methods, data and information on how it will be implemented. If it gets 6M VP and the yes option.

1.

2.

Aragon exists to be a decentralized platform that allows individuals to creat and seamlessly manage organizations on the Ethereum blockchain. Aragon is also an on-chain governance platform for DAOs. With Aragon, DAOs can conduct governance on-chain without writing a singleline of code. DAOs can also customize the votes on Aragon to suit thier needs.

(Video)

Boardroom is a DAO governance portal that is powered by Boardroom's API, Boardroom is a governance framework agnostic interface that allows DAOs to standardize actions like voting and delegation - with Boardroom, DAO members can participate in distributed governance.

(Video)

Decentraland DAO Onboarding process is very easy; , react to any emoji and that's all. You can start engaging with the community.

One of the easiest ways to earn MANA is by investing in plots (LAND) which you can sell later. On Decentraland, you can take advantage of the in-game activities to help you earn MANA. In fact, users can create 3D assets and sell them, lastly, you can get MANA by purchasing on DEX exchanges.

DAOs, by their very nature, are decentralized, digital-first, and often operate without a hierarchical structure. This unique setup presents its own set of communication challenges:

Global Dispersion: DAO members are often spread across different time zones, making real-time communication challenging.

Lack of Central Authority: Without a clear hierarchy, decision-making processes can be prolonged, and reaching consensus can be more complex.

Reliance on Digital Platforms: DAOs operate primarily online, which means they are heavily reliant on digital communication tools. This can lead to issues like platform outages, miscommunication due to lack of face-to-face interaction, and information overload.

Asynchronous Communication: Given the global nature of DAOs, much of the communication happens asynchronously, which can lead to delays and potential misinterpretations.

Transparency and Security: DAOs operate on principles of transparency and security. Ensuring that all communications are both open and secure can be a delicate balance to strike.

Let's tackle each one by one, and see how we can address them.

Problem: DAO members are spread across different time zones, making real-time communication challenging.

Scheduling Tools: Use lettucemeet to find times to meet

Automated Time Converters: Make sure everyone in your Discord community knows what time events are in their own time zone:

Problem: Without a clear hierarchy, decision-making processes can be prolonged, and reaching consensus can be more complex.

Voting Platforms: Tools like Aragon or Snapshot can facilitate decentralized decision-making through voting mechanisms. See our research on to learn about these tools

Discussion Forums: Platforms like or where structured discussions can take place, ensuring every voice is heard. Alternatively, Discord Forums can be an easy add on to your community.

Role Management: Tools like solve the problem of knowing What is going on within the DAO, and who is responsible for what. Find exactly who you need to talk to to move on with a project in an easy and intuitive way.

Problem: Much of the communication happens asynchronously, leading to potential delays and misinterpretations.

Threaded Discussion Tools: Using Discord effectively will get you and your community a long way to become better async communicators. See our extensive Discord guideline for DAOs:

Documentation Platforms: We prefer and Obsidian for all our intraDAO documentation but the choice of tool doesn't matter much, you can use tools like Confluence or Google Docs where meeting notes, decisions, and updates can be documented for members to access at their convenience. What matters more are the processes, and the rules for getting stuff done. You can see some of our guidelines on this:

Problem: DAO communications primarily occur in digital meeting environments. These need to be well run.

Choose your tool well: There are many other tools than Zoom. Check some out below:

Lace Wallet is a fast, easy to use and well documented Cardano wallet.

It is available on Google Chrome as an extension.

Lace wallet can be expanded to a full web app from the extension.

Crypto assets' value can be seen in a variety of FIAT currencies.

This wallet is not open-source.

NFTs and Tokens can be seen on Lace wallet.

There is address book support.

Lace wallet currently does not support multiple wallets.

Lace wallet has preprod and preview testnet supports.

Lace wallet has dApp support.

Lace wallet has staking support.

Lace is supporting Ledger Nano X, Nano S and Nano S Plus.

Lace supports 12, 15, 24 word seed phrases.

You should follow below steps to stake your ADA in your wallet.

Go to Staking

Search for a Pool and choose the pool you want

Delegate your Stake

After you delegate, you can view your delegated stake pool on the Staking page.

Total balance of your wallet will be delegated to the pool of your choice. Lace wallet currently does not support unstaking your ADA but you can choose another stake pool or you can send or receive ADA.

Please let us know if you encounter any issues.

DAO tools are software applications built on blockchain technology that facilitate the creation and management of DAOs. DAOs are organizations that are fully decentralized and autonomous, with decisions made through a consensus process on the blockchain. DAO tools can include platforms for governing a DAOs (like Summon Platform or Clarity Protocol) or managing a DAOs treasury (like Round Table).

DAO tools enable the creation of transparent, democratic, and efficient organizations. They allow for the automation of decision-making and administrative processes, the creation of transparent and tamper-proof records of all transactions and decisions, and the decentralization of authority and ownership.

DAO tools serve a variety of purposes, including but not limited to:

Governance: Tools for proposal creation, voting, and decision enforcement help DAOs make collective decisions in a transparent and democratic manner.

Smart Contract Development: Tools for helping communities to develop their own smart contracts.

Treasury Management and Payments: DAOs often hold substantial assets in their treasuries. Tools for treasury management help DAOs track, manage, and allocate these assets effectively and securely.

DAO tools can provide several benefits for DAOs:

Efficiency: DAO tools can automate many of the processes involved in running a DAO, saving time and reducing the potential for human error.

Transparency: By facilitating clear communication and decision-making processes, DAO tools can help ensure that all stakeholders have a clear understanding of what's happening within the DAO.

Accessibility: DAO tools can make it easier for non-technical stakeholders to participate in the DAO, broadening the pool of potential contributors and increasing the diversity of perspectives within the DAO.

Our main aim is to cover all DAO Tools on Cardano blockchain we can find but to have more understanding of DAO tools we also conduct research on DAO tools on other chains or as we call it the Ocean.

Author: Emir Olgun

Date: 19 April 2023

Token distribution is an important task for DAOs. It can be a time consuming task to distribute to all members safely. TosiDrop is a token distribution platform developed for Cardano and Ergo blockchains. They offer a service for communities to distribute tokens to their members in a secure manner. They also have their own tokens called cTOSI and eTOSI. cTOSI runs on Cardano and eTOSI runs on Ergo. The

On Cardano, TosiDrop offers two ways to distribute tokens. Airdrop and Vending Machine style. On Ergo blockchain, only airdropping method is available.

TosiDrop platform also has stake pools. Users can delegate to support them and pay no fee on claims.

Airdrop: TosiDrop offers a service of airdropping tokens to the community members through uploading a list of addresses via a CSV file.

Vending Machine: On this method, members of a community sends ADA to an address and receives tokens in return.

There are two billon tokens. One million of them is cTOSI on Cardano and one million is eTOSI on Ergo. These tokens are used for governance and revenue sharing. 10% percent of the tokens are allocated to the core team and 30% are being distributed to NETA/cNETA community. 60% are being distributed to the public.

TosiDrop charges communities a fee for using TosiDrop services. These fees generate revenue in the form of ADA and ERG and will be enjoyed by holders of the TOSI tokens.

Currently the TosiDrop platform does not support adding your project to their platform. Only way to use it to distribute tokens as a DAO is to contact the developers of TosiDrop. They will have a different method in the future.

Token distribution is a very important thing for DAOs. They can generate funds for their projects via these tokens. TosiDrop is a platform to make this task easy and safe. Token distribution is one of the services needed by DAOs and there are platforms on Cardano that aim to solve more of those problems. I believe those tools can be much more helpful for DAOs.

Author: Emir Olgun

Date: 19 April 2023

Token distribution is an important task for DAOs. It can be a time consuming task to distribute to all members safely. TosiDrop is a token distribution platform developed for Cardano and Ergo blockchains. They offer a service for communities to distribute tokens to their members in a secure manner. They also have their own tokens called cTOSI and eTOSI. cTOSI runs on Cardano and eTOSI runs on Ergo. The

On Cardano, TosiDrop offers two ways to distribute tokens. Airdrop and Vending Machine style. On Ergo blockchain, only airdropping method is available.TosiDrop platform also has stake pools. Users can delegate to support them and pay no fee on claims.

Airdrop: TosiDrop offers a service of airdropping tokens to the community members through uploading a list of addresses via a CSV file.

Vending Machine: On this method, members of a community sends ADA to an address and receives tokens in return.

There are two billon tokens. One million of them is cTOSI on Cardano and one million is eTOSI on Ergo. These tokens are used for governance and revenue sharing. 10% percent of the tokens are allocated to the core team and 30% are being distributed to NETA/cNETA community. 60% are being distributed to the public.

TosiDrop charges communities a fee for using TosiDrop services. These fees generate revenue in the form of ADA and ERG and will be enjoyed by holders of the TOSI tokens.

Currently the TosiDrop platform does not support adding your project to their platform. Only way to use it to distribute tokens as a DAO is to contact the developers of TosiDrop. They will have a different method in the future.

Token distribution is a very important thing for DAOs. They can generate funds for their projects via these tokens. TosiDrop is a platform to make this task easy and safe. Token distribution is one of the services needed by DAOs and there are platforms on Cardano that aim to solve more of those problems. I believe those tools can be much more helpful for DAOs.

Research on the regulatory picture of blockchains

Building solutions on the blockchain come with many legal questions that need to be answered. Legal frameworks around blockchains are constantly being updated with new laws being drafted globally.

Users, developers, and decentralized organizations need to be aware of the developments, and the legal obligations that come with participating on blockchain. This is why one of our main topics of research is to understand the regulatory landscape.

All research here are outlined in our Project Catalyst proposal. See that here: https://cardano.ideascale.com/c/idea/64605

Our research covers a broad spectrum of thirteen key areas:

Legal status of littlefish Action NFTs: Action NFTs are our own technology. They are the records of work, stored as NFTs. What the concept. This new method of doing business, of getting paid, raises questions about its legal implications. Learn about it here:

Legal status of earning through Project Catalyst: There are many earning opportunities in Project Catalyst: proposals, proposal assessments, Challenge Teams, etc. What tax and other obligations earning in this environment is not obvious for all. Learn about it here:

Legal frameworks for Decentralized Organizations: What legal frameworks are available for Decentralized (Autonomous) Organizations? What should be considered? At what point does a DAO/DO need a legal standing? What challenges will new DAOs face if they don’t have legal standing? What legal ramifications are there for organizations and participants of decentralized organizations? Learn about them here:

Author: Donald

Date: 19 Apr 2023

Democratizing governance through blockchain technology has become an exciting endeavor, championing the principles of decentralization and transparency. Enter Voteaire, a user-friendly platform designed to facilitate the creation and operation of on-chain voting systems within the Cardano ecosystem. As an embodiment of these principles, it is transforming traditional governance models, highlighting transparency, decentralization, and accessibility for all, while eliminating the need for central authorities.

By employing blockchain's decentralization feature, Voteaire helps protect the voting process against undue influence or manipulation, distributing decision-making power across a vast network of participants. Moreover, the platform ensures accountability and openness by permanently recording all transactions, including proposals and votes, on the blockchain. Every piece of information, including data specifications, are openly accessible in a public, open-source repository for verification purposes.

Voteaire redefines on-chain voting, leveraging the immutable nature of blockchain technology. Based on the initial concept introduced by SPOCRA for their board of directors' vote, it operates by extending this fundamental principle. The platform employs transaction metadata to permanently store ballot proposals and votes on-chain, with the 'metadata key 1916' as an homage to the year Canadian women first gained suffrage. Anyone with the necessary technical proficiency can probe the blockchain directly to validate the voting results, ensuring transparency and immutability.