Ensuro

Author: Creed

Date: 27 Feb 2023

Introduction

It is known that Ensuro is a decentralized insurance platform built on the Ethereum blockchain. The platform is designed to provide a more efficient, transparent, and secure way for individuals and businesses to buy and sell insurance policies.

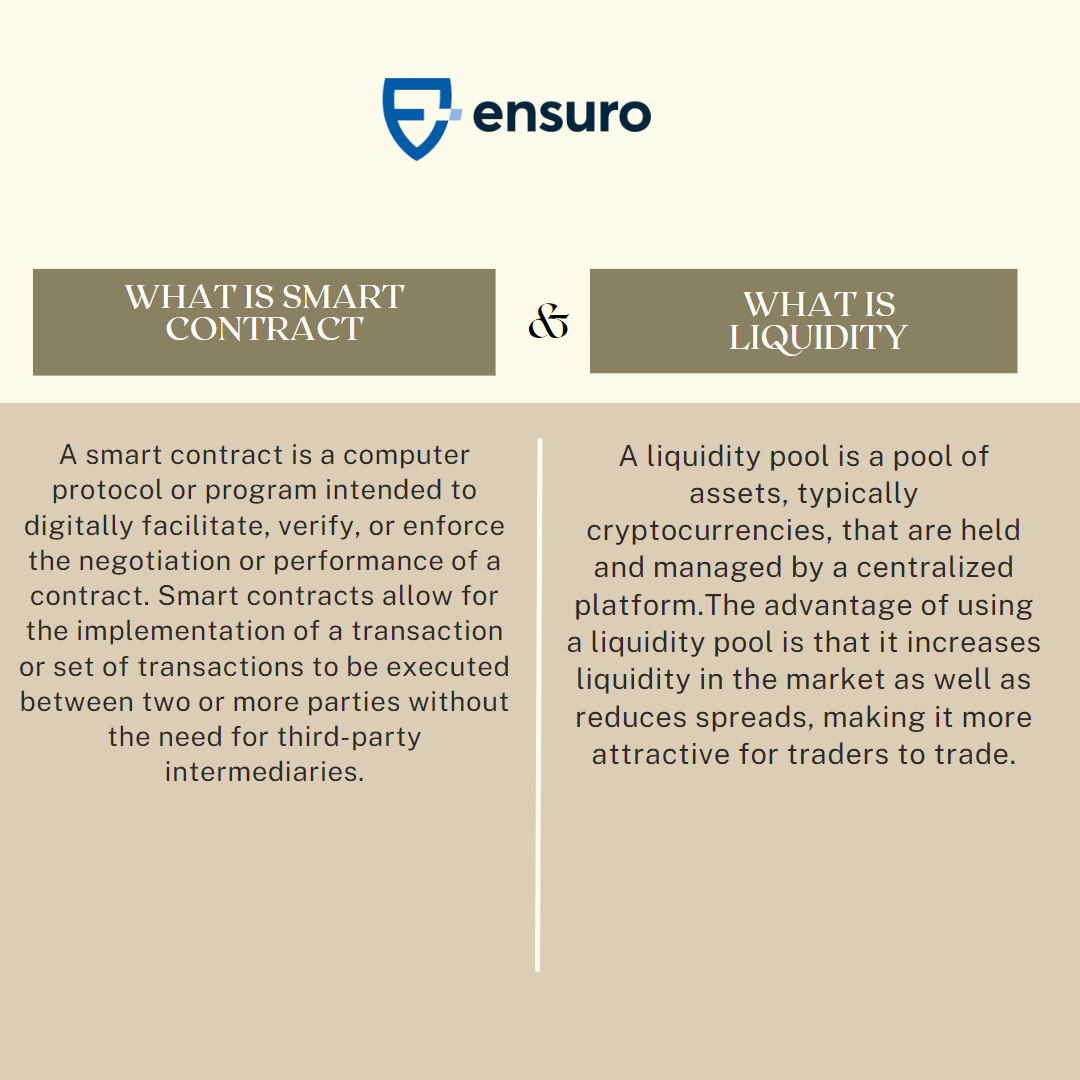

The Ensuro platform operates using smart contracts, which are self-executing contracts with the terms of the agreement between the buyer and the seller being directly written into lines of code. This eliminates the need for intermediaries such as brokers and underwriters, which can lead to faster and more cost-effective insurance transactions.

Ensuro

How Does Ensuro Work?

It might interest you to know that Ensuro protocol exists to help us build liquidity pools to lid insurance risk. In the meantime, users are allowed to become an insurer, it also helps to provide a fast and convenient path to capital for insurtech companies as well as risk model providers who are looking to striking products. And also, it's also flagrant that Ensuro might reach the level of the current Decentralized Finance (DeFi) space.

Ensuro is a decentralized insurance platform that aims to provide affordable and accessible insurance services to individuals and businesses. The platform is built on Ethereum blockchain and uses smart contracts to automate insurance policies, claims processing, and payments.

The traditional insurance industry is plagued by high costs, low transparency, and a lack of innovation. Insurance companies often charge high premiums and are slow to process claims, leaving customers frustrated and dissatisfied. Ensuro is more efficient than traditional trading because it utilizes cutting-edge technology to automate the entire trading process, meaning transactions can be completed much faster than manually executing orders. This automation also helps to keep costs down since Ensuro has a low cost-per-trade structure. In addition, its liquidity pooling system ensures that the market is highly liquid and enables traders to access the best available prices while providing additional layers of security. The combination of automation and liquidity pooling make Ensuro one of the most efficient and secure trading platforms available.

Ensuro seeks to address these issues by using blockchain technology to create a more efficient and cost-effective insurance system. Since the advent of blockchain, a lot has evolved - millions of people from all walks of life are leveraging it already. Needless to say, the web3 industry is growing progressively plus, we've also heard of different possible ways to earn money through them.

Tokenization made its debut during the era of web3 - this gave people their own rights to digital assets. That being said; ensuro also adopted the tokenization technology.

What Does Ensuro Undertake?

The Ensuro protocol has some series of actions it takes; the first set of actions is the deposit action. With the deposit action; all users can seamlessly deploy capital in any of the liquidity pools - the deposit action could be to update index, update user balance, or token interest rate.

On the other hand, the withdraw action is the second set of actions Ensuro carries out - in this case, users are allows to exchange insert amount to withdraw, update index, withdraw amount just to mention a few.

Ensuro has two main features which I'd talk about in a couple of minutes - the first which is referred to as π-eTokens:

The π-eTokens is one of the technologies used by Ensuro - it is worth knowing that each of the π seamlessly corresponds to a different cashback period. In one sense; whenever a user deploys a capital in any pool, the π automatically sends a withdraw transaction, once it is accepted, they would have to wait for a little while longer - the waiting time could be as long as the cashback period of the pool.

The second technology used by Ensuro is known as Tokenization - the word is no longer a new phenomenon. Tokenization is used to provide access to ownership. For the sake of clarity, we could say that Tokenization is the process of converting the rights to an artwork into a digitalized token.

The Ensuro platform allows anyone to create and purchase insurance policies without the need for intermediaries or middlemen. Smart contracts are used to automate the insurance process, from policy creation to claim processing and payment. This eliminates the need for paperwork, reduces administrative costs, and increases transparency.

The Ensuro platform uses a unique risk pool model to determine the premiums for insurance policies. A risk pool is a group of policyholders who share the risk of potential losses. The premiums are calculated based on the size of the risk pool and the likelihood of a claim being made.

This means that policy holders only pay for the actual risks they face, rather than being charged a flat rate that may not reflect their actual risk profile. One of the key advantages of Ensuro is its transparency. All policy terms and conditions are stored on the blockchain, which means they are accessible to anyone and cannot be altered or tampered with.

This provides customers with peace of mind and helps to build trust in the insurance process. Ensuro also uses a decentralized claims processing system. When a claim is made, it is automatically processed by the smart contract and paid out to the policyholder. This eliminates the need for claims adjusters and reduces the time it takes to process claims. Additionally, because the claims process is automated, there is less chance of fraud or errors.

Ensuro's platform is built on Ethereum blockchain, which is known for its security and reliability. The use of smart contracts also ensures that policies and claims are processed in a secure and transparent manner. This provides customers with a high level of trust in the Ensuro platform. In addition to its benefits for individual policyholders, Ensuro also provides opportunities for businesses to participate in the insurance market.

Businesses can create their own risk pools and sell insurance policies to their customers. This can help businesses to differentiate themselves from their competitors and provide additional value to their customers.

Conclusion

Currently there is not a project that does what Ensuro does in Cardano Ecosystem but Ensuro can still be useful for the organizations on Cardano Ecosystem.

Ensuro's decentralized insurance platform has the potential to revolutionize the insurance industry. By using blockchain technology and smart contracts, Ensuro is able to create a more efficient, cost-effective, and transparent insurance system. The platform's focus on risk pools and decentralized claims processing helps to reduce costs and increase transparency, while its use of the Ethereum blockchain ensures security and reliability.

Overall, Ensuro is an exciting development in the world of insurance. As more individuals and businesses become aware of the benefits of decentralized insurance, it is likely that Ensuro will continue to grow and evolve. If you are interested in learning more about Ensuro and its platform, you can visit the company's website or join the community on social media.

Additional Information

Relevant Links:

Disclaimer: The content is for informational purposes only, may include the author's personal opinion, and does not necessarily reflect the opinion of littlefish Foundation.

Last updated